The Best Investment Portfolio

There is no such thing as the perfect investment portfolio. There are multiple ways you can set up your investments depending on your life choices, but we will look at a couple of contenders for the title.

The Guaranteed Investment Portfolio

The guaranteed investment portfolio only invests in high interest rate bank accounts. This is the only guarantee and is based on the solvency of that bank account. So, a “guarantee” is really a myth.

But, for ultra conservative investors, you can actually invest via an offshore investment bond for tax purposes & legal protection whilst investing in high interest rate bank accounts only.

The interest rate may not cover the charges for the bond and may also not be enough to cover the increase in the inflation rate.

The 60/40 Portfolio & Why Its No Longer Good Enough

For many years, a large percentage of financial planners and stockbrokers crafted portfolios for their clients that were composed of 60% equities and 40% bonds or other fixed-income offerings. And these so-called balanced portfolios did rather well throughout the 80s and 90s.

But, a series of bear markets that started in 2000 coupled with historically low-interest rates have eroded the popularity of this basic approach to investing. Some experts are now saying that a well-diversified portfolio must include more asset classes than just stocks and bonds. As we’ll see below, these experts feel that a much broader approach must now be taken in order to achieve sustainable long-term growth.

Create the Perfect Investment Portolio

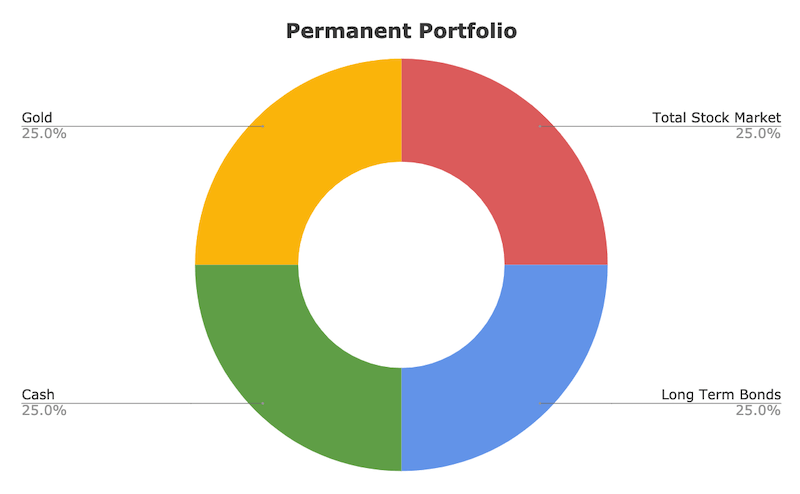

The Harry Browne Permanent Portfolio

The permanent portfolio is an investment portfolio designed to perform well in all economic conditions. It was devised by free-thinking market investment analyst, Harry Browne, in the 1980s.

The permanent portfolio is composed of an equal allocation of stocks, bonds, gold, and cash, or Treasury bills.

- stocks 20%

- bonds 20%

- gold 20%

- treasuries 20%

- cash 20%

Warren Buffett’s Portfolio

The 90/10 Strategy.

According to Buffett, it’s a portfolio allocation rule wherein you delegate 90% of your portfolio to low-cost index equity funds and 10% to short-term government bonds.

Buffet cites this strategy as a cornerstone of long-term investment stability. Also note, that this is aimed at US stocks & bonds in US dollars.

- stocks 90%

- bonds 10%

Modern Portfolio Theory (MPT)

Modern portfolio theory (MPT) is a theory in investment and portfolio management that shows how an investor can maximize a portfolio’s expected return for a given level of risk by altering the proportions of the various assets in the portfolio. Given a level of expected return, an investor can alter the portfolio’s investment weightings to achieve the lowest level of risk possible for that rate of return.

Modern portfolio theory says that it is not enough to look at the expected risk and return of one particular stock. By investing in more than one stock, an investor can reap the benefits of diversification—chief among them, a reduction in the riskiness of the portfolio. MPT quantifies the benefits of diversification, or not putting all of your eggs in one basket.

Exchange Traded Fund Portfolios

An exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same way a regular stock can. An ETF can be structured to track anything from the price of an individual commodity to a large and diverse collection of securities. ETFs can even be structured to track specific investment strategies.

A well-known example is the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index. ETFs can contain many types of investments, including stocks, commodities, bonds, or a mixture of investment types. An exchange traded fund is a marketable security, meaning it has an associated price that allows it to be easily bought and sold.

It is possible to combine Modern Portfolio Theory with ETFs.

Example

- stocks (SPY ETF)

- bonds (TLT ETF)

- gold etf (GLD ETF)

- cash

Investing in a Multi Asset Portfolio

The idea is to invest in a wide range of assets with a low correlation to each other. For example, over history, stocks and bonds usually go in different directions. As stocks go up, there is a sell off of bonds. Of course, this is not always the case and often both go up.

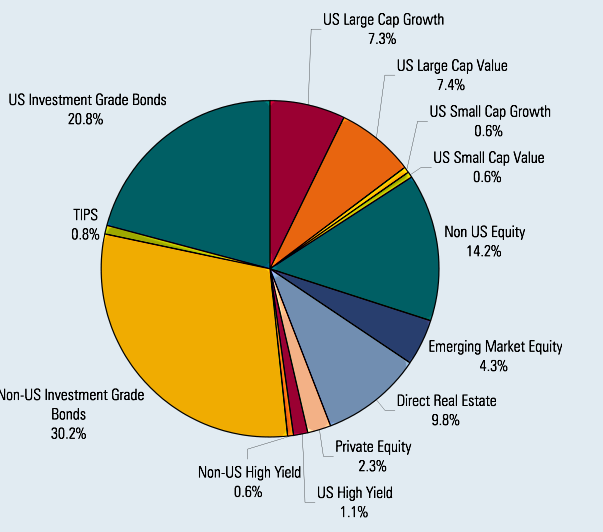

Here is an example of an investment in multiple assets, including cryptocurrency as part of a diversified balanced portfolio set up by a qualified financial adviser.

The Multi Asset Portfolio

Here is an example of a multi asset portfolio as part of a diversified balanced portfolio set up by a qualified financial adviser.

A portfolio can also invest in cryptocurrencies. At the moment, Bitcoin avoids capital controls and is also a currency hedge.

You can read more about investing in cryptocurrency here.

- Equity funds

- Bond funds

- Commodity funds

- Property funds

- Gold funds

- Bitcoin trust

This is an example of a balanced investment portfolio set up for a middle aged person, looking to set up an insurance bond aimed at retirement. An insurance bond can offer tax protection as well as security. The insurance bond can be passed onto any named beneficiary upon death.

For example, your investment bond can be cashed out to your partner, child or grandchildren upon death. You can also choose for the bond to continue upon death with your loved ones receiving an income upon death.

Investment portfolios can be tailored to adjust the percentages held of each asset based on a clients’ risk profile and investment horizon.

Let’s Connect.