How to Invest in a Bitcoin Trust?

We believe that digital currencies such as Bitcoin, will revolutionize our legacy economic, political, and social systems. With that transformation comes a meaningful generational shift in how institutions and individuals approach investing. That’s where setting up a Bitcoin Trust or Cryptocurrency Trust comes into play.

Since its launch in 2009, Bitcoin has become the world’s best-known and most popular cryptocurrency exchange, with more than 76 million users worldwide (less than 1% of world population)

About 46 million Americans now own at least a share of Bitcoin—that equals about 17% of the adult population. And some of those people are looking to integrate the cryptocurrency into their personal financial plans—including their life insurance.

Read here, why do I need to hold Bitcoin in a secure physical vault?

You can set up a Bitcoin Trust for yourself, your children or your grandchildren.

In order to invest in a Bitcoin trust, you need to set it up through a qualified financial adviser. What is Bitcoin?

Read about the pitfalls of investing in Bitcoin.

Key Points:

- $50,000 minimum investment

- no knowledge of Bitcoin required; no need to hold or hide private keys in a water-resistant, fireproof safe; the keys are held in trust in a secure vault

- Client service from Coinbase’s Institutional Coverage team in London, Dublin, New York, Chicago, and San Francisco.

- Bitcoin is bought and held in trust

- Highest level of security

- 7 points of trust

- 7 signatures required for any transaction: you, your adviser, the insurance company, 3 ring signatures at the trust & Coinbase custodial sign off

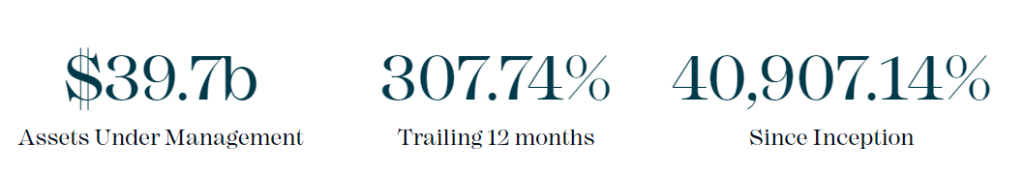

- $39bn+ under management

- assets are stored in offline cold storage with Coinbase’s institutional grade “cold wallets” in a secure vault.

- Coinbase Custody Trust Company LLC is the custodian

- The custodian is a fiduciary under section 100 of the NY banking law & a qualified custodian for purposes of Rule 206(4) – 2(d)(6) under the Investment Advisers Act of 1940, as amended.

- The trust is transparent & audited. Shares can be bought & sold continuously throughout the trading day.

Bitcoin Fund Returns

Fund inception date: 25/09/2013

Trailing 1 Month: 22.99%

Trailing 3 Month: 55.29%

Trailing 12 Months: 307.74%

*correct as of 8th Nov, 2021

How to Set Up an Ethereum Trust

In order to invest in an Ethereum trust, you need to set it up through a qualified financial adviser. What is Ethereum?

Key Points:

- $50,000 minimum investment

- Cryptocurrency is bought and held in a trust

- Digital Large Cap Cryptocurrency Fund

- Highest level of security

- no knowledge of Ethereum required; no need to hold or hide private keys in a water-resistant, fireproof safe; the keys are held in trust in a secure vault

- 7 points of trust

- 7 signatures required for any transaction: you, your adviser, the insurance company, 3 ring signatures at the trust & Coinbase custodial sign off

- $39bn+ under management

- assets are stored in offline cold storage with Coinbase’s institutional grade “cold wallets” in a secure vault.

- Coinbase Custody Trust Company LLC is the custodian

- The custodian is a fiduciary under section 100 of the NY banking law & a qualified custodian for purposes of Rule 206(4) – 2(d)(6) under the Investment Advisers Act of 1940, as amended.

- The trust is transparent & audited. Shares can be bought & sold continuously throughout the trading day.

Ethereum Fund Returns

Fund inception date: 01/02/2018

Trailing 1 Month: 31.52%

Trailing 3 Month: 64.78%

Trailing 12 Months: 977.73%

*correct as of 8th Nov, 2021

How to Set Up a Cryptocurrency Trust

In order to invest in a Cryptocurrency trust, you need to set it up through a qualified financial adviser. What is Cryptocurrency?

Key Points:

- $50,000 minimum investment

- Cryptocurrency is bought and held in a trust

- Digital Large Cap Cryptocurrency Fund

- Highest level of security

- no knowledge of cryptocurrencies required; no need to hold or hide private keys in a water-resistant, fireproof safe; the keys are held in trust in a secure vault

- 7 points of trust

- 7 signatures required for any transaction: you, your adviser, the insurance company, 3 ring signatures at the trust & Coinbase custodial sign off

- $39bn+ under management

- assets are stored in offline cold storage with Coinbase’s institutional grade “cold wallets” in a secure vault.

- Coinbase Custody Trust Company LLC is the custodian

- The custodian is a fiduciary under section 100 of the NY banking law & a qualified custodian for purposes of Rule 206(4) – 2(d)(6) under the Investment Advisers Act of 1940, as amended.

- The trust is transparent & audited. Shares can be bought & sold continuously throughout the trading day.

Cryptocurrency Fund Returns

Fund inception date: 01/02/2018

Trailing 1 Month: 23.96%

Trailing 3 Month: 57.10%

Trailing 12 Months: 383.72%

*correct as of 8th Nov, 2021

Cryptocurrency Holdings by Country

The World’s Top 10 Crypto Countries

Nigerians are the most open to crypto trading and spending, but the country is hardly alone in its rapid adoption of what was a mostly unfamiliar novelty until very recently. Southeast Asia makes a strong showing and one country from Latin America breaks the top five, but the world’s most powerful countries with the biggest economies fall on the bottom half of the list. The world’s top 10 crypto countries, according to the Statista data, are:

- Nigeria: 32%

- Vietnam: 21%

- Philippines: 20%

- Turkey: 16%

- Peru: 16%

- Switzerland: 11%

- India: 9%

- China: 7%

- U.S.: 6%

- Germany: 5%

- Japan: 4%